The BluSmart cab disaster shocked India’s ride-hailing industry in 2025. What started as safety incidents soon revealed massive financial fraud. Consequently, thousands of drivers lost jobs overnight. Meanwhile, passengers faced service disruption across major cities.

The electric cab company once promised clean and reliable transport. However, a series of unfortunate events destroyed public trust. Furthermore, regulatory investigations exposed serious corporate governance failures. As a result, BluSmart suspended operations indefinitely.

The BluSmart Cab Disaster Unfolds

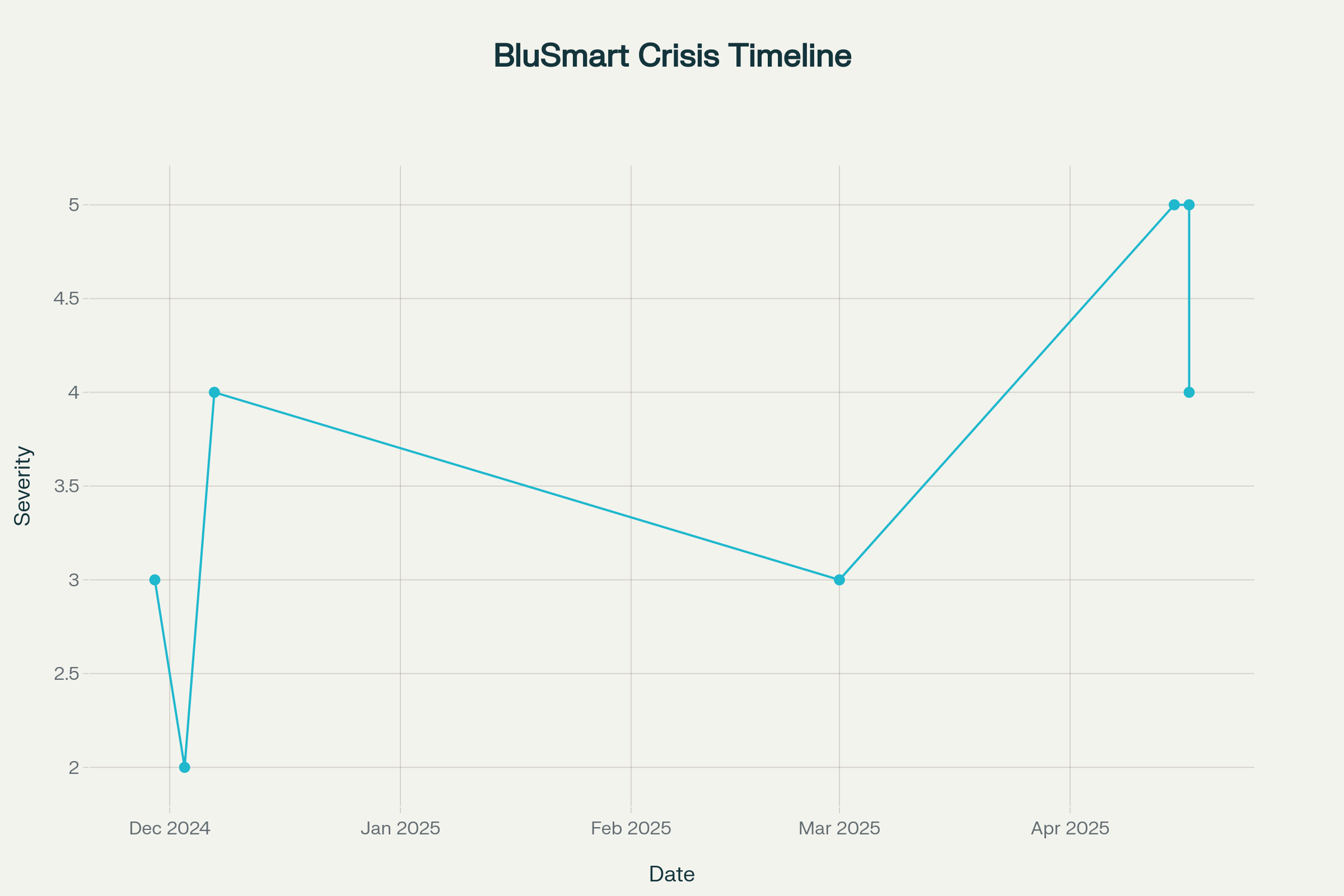

The BluSmart cab disaster began with isolated safety incidents in late 2024. Initially, these seemed like rare occurrences. Nevertheless, they signaled deeper systemic problems within the company.

Gunpoint Robbery Shocks Passengers : BluSmart cab disaster

The first major incident occurred on November 29, 2024. A BluSmart driver robbed a woman and her young child at gunpoint while driving through Gurugram on a late evening. The driver, Sonu Singh, threatened them with a gun and forced the victim to transfer ₹55,000 instantly through a UPI app. After receiving the money, he pushed them out of the cab, snatched their belongings, and quickly fled the crime scene.

Police arrested Singh within 24 hours of the incident. However, the damage to BluSmart’s reputation was immediate. Moreover, this incident raised serious questions about driver background checks. The company’s response seemed inadequate to many customers.

BluSmart co-founder Anmol Jaggi referred to the incident as a “personal” matter, distancing the company from direct accountability. He emphasized their strict safety protocols and thorough background verification processes for all drivers to reassure the public. Nevertheless, public confidence in BluSmart’s services began to waver significantly following the shocking robbery incident in Gurugram.

Read More: Free Perplexity Pro, Grab for a Year on Airtel

BluSmart cab disaster :Brake Failure Accident Injures Passenger

Another serious incident took place on December 7, 2024, in Bengaluru, further intensifying scrutiny of BluSmart’s safety measures and driver accountability. During a routine ride, passenger Danish R suffered critical injuries when the BluSmart cab lost control and crashed midway. Disturbingly, the driver later confessed that the vehicle’s brakes had failed earlier, but he had continued driving, ignoring the potential danger.

Severe front-end damage to a blue car after a collision, illustrating the impact of a cab accident

Danish sustained a broken nose and a fractured cheekbone due to the crash, requiring immediate and extensive medical attention for recovery. His total medical expenses exceeded ₹2 lakh, with doctors prescribing a recovery period of nearly three months filled with discomfort. Beyond the physical injuries, he experienced immense emotional trauma, including anxiety and fear of using ride-hailing services. The incident completely shattered his trust in BluSmart, leaving him disillusioned with its promises of safety.

BluSmart’s response to Danish’s case proved disappointing. Despite multiple emails, the company offered no meaningful compensation or accountability. Their customer service told him brake failure would have happened earlier if true. This callous response further damaged their reputation.

Financial Fraud Behind BluSmart Cab Disaster

The safety incidents were just the beginning of the BluSmart cab disaster. Subsequently, financial irregularities came to light. Meanwhile, regulatory authorities began investigating the company’s parent organization.

Read More: iPhone 17 Air Launches September: Ultra-Slim Revolution

SEBI Exposes ₹262 Crore Fraud

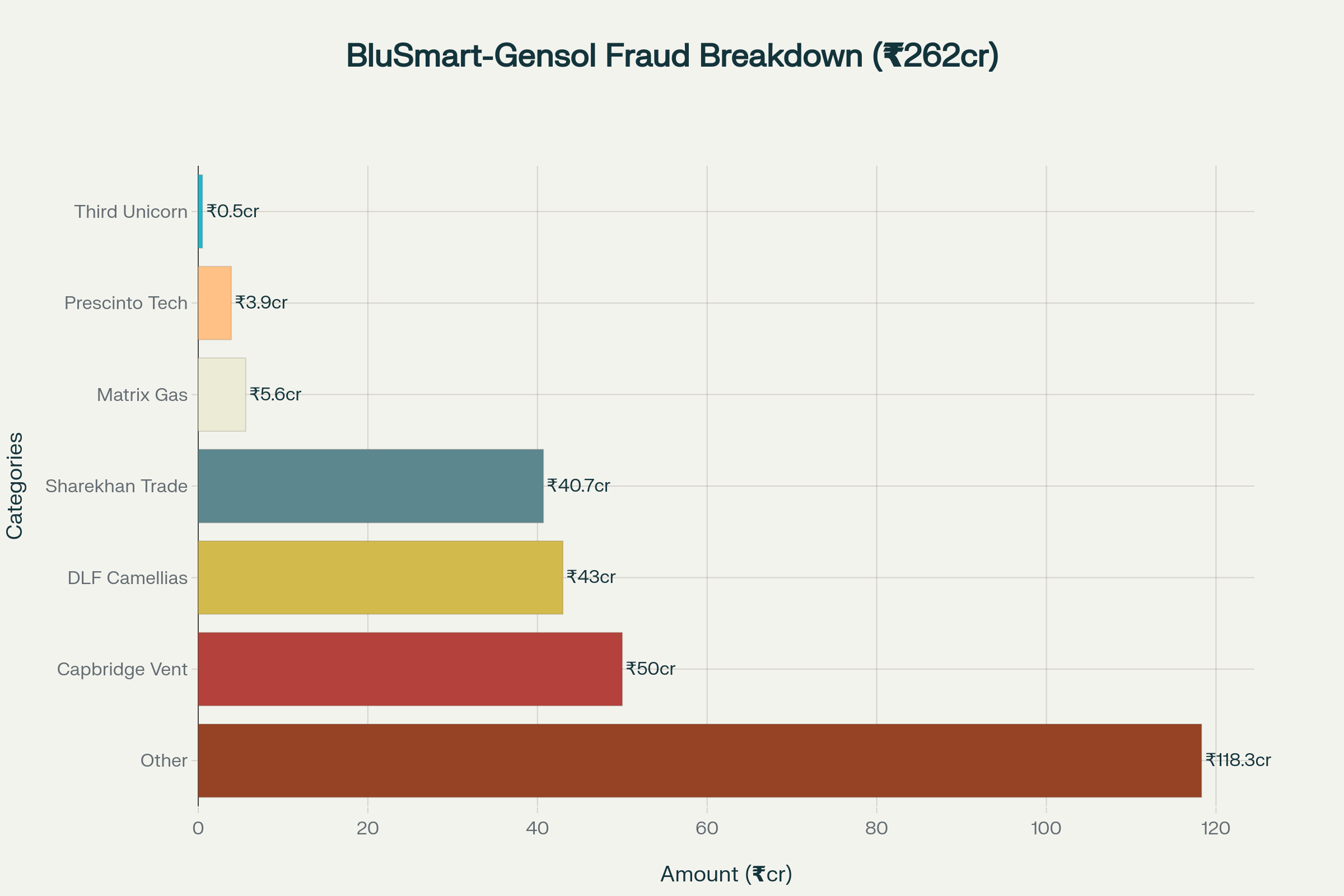

On April 15, 2025, SEBI issued a damning order against Gensol Engineering. The promoters, Anmol and Puneet Jaggi, allegedly diverted ₹262 crore. These funds were meant for purchasing electric vehicles for BluSmart.

Breakdown of ₹262 crore diverted funds in BluSmart-Gensol fraud case

Instead of buying 6,400 vehicles, only 4,704 were purchased. The remaining money went toward luxury purchases and personal expenses. SEBI found that promoters treated the company like their “personal piggy bank”.

The diverted funds purchased a ₹43 crore apartment in DLF Camellias, Gurugram. Additionally, money went to golf equipment, foreign travel, and credit card payments. Some funds even reached Ashneer Grover’s Third Unicorn company.

Complex Fund Routing Exposed

SEBI’s investigation revealed sophisticated fund diversion techniques. Money moved through multiple connected companies to obscure the trail. For instance, ₹50 crore went to Capbridge Ventures LLP, controlled by the promoters.

The fraud involved circular transactions between various group companies. These included Gensol EV Lease, GoSolar Ventures, and BluSmart Mobility. Furthermore, ₹40.7 crore was used for trading Gensol’s own shares.

SEBI banned both Jaggi brothers from securities markets. They also cannot hold key positions in any listed company. Moreover, a forensic audit was ordered for Gensol and related entities.

Read More : Astronomer CEO Caught in Viral Coldplay Moment

Impact of BluSmart Cab Disaster

The BluSmart cab disaster had widespread consequences across India. Thousands of people lost their livelihoods overnight. Meanwhile, customers struggled with service disruptions and wallet refunds.

BluSmart email announcing temporary closure of bookings with refund policy if services don’t resume within 90 days

10,000+ Drivers Left Jobless

The sudden shutdown left over 10,000 drivers without work. These drivers received no advance notice about the closure. They simply got a message to return vehicles to hubs.

Many drivers had left better-paying jobs to join BluSmart. Arjun Singh, a commerce graduate, left his ₹10,000 school job for ₹40,000 monthly earnings. He felt proud working for BluSmart until the sudden collapse.

Finding new employment proved challenging for former BluSmart drivers. The job market became saturated with thousands of ex-drivers seeking work. Moreover, dealers demanded ₹20,000-₹30,000 commissions for new positions.

Timeline of key events in the BluSmart disaster (November 2024 – April 2025)

Customer Wallets and Service Disruption

BluSmart customers faced immediate service disruption on April 17, 2025. The app stopped accepting bookings across Delhi-NCR, Mumbai, and Bengaluru. Many passengers were left stranded without their preferred transport option.

Customers with money in BluSmart wallets worried about refunds. The company promised refunds within 90 days if services don’t resume. However, given the financial troubles, many doubted these promises.

The sudden closure particularly affected airport commuters. BluSmart had become reliable for early morning flights and late-night arrivals. Passengers now faced surge pricing and unreliable service from competitors.

Industry-Wide Implications

The BluSmart cab disaster sent shockwaves through India’s startup ecosystem. It highlighted serious corporate governance gaps in new-age companies. Moreover, it raised questions about regulatory oversight of listed entities.

Electric BluSmart car marked with a bold red ‘SCAM!’ stamp highlighting the alleged BluSmart fraud case

Retail investors suffered massive losses as Gensol shares crashed 85%. The shareholder base had grown from 155 to over 110,000 investors. Many small investors lost their life savings in the collapse.

The incident also damaged trust in electric vehicle mobility solutions. BluSmart was considered a success story in India’s EV transition. Its failure set back confidence in sustainable transportation initiatives.

Regulatory Response and Investigation

Following the BluSmart cab disaster, multiple agencies launched investigations. The Corporate Affairs Ministry began studying potential violations. They focused on fund diversions and promoter misconduct.

SEBI’s investigation started after credit rating downgrades in 2024. Both ICRA and CARE had downgraded Gensol due to loan defaults. This triggered regulatory scrutiny of the company’s finances.

The investigation revealed forged documents and misleading statements. Lenders IREDA and PFC were deceived through fake conduct letters. These letters falsely claimed regular debt servicing.

Lessons from the BluSmart Cab Disaster

The BluSmart cab disaster offers important lessons for stakeholders. Investors must demand better corporate governance from startups. Moreover, regulators need stronger oversight of connected party transactions.

The incident shows how safety lapses can signal deeper problems. Companies must prioritize passenger safety over growth targets. Furthermore, proper background checks for drivers remain crucial.

For the ride-hailing industry, the disaster highlights platform responsibility. Companies cannot simply blame individual drivers for safety incidents. They must ensure comprehensive safety protocols and accountability.

Looking Ahead

The BluSmart cab disaster will likely reshape India’s mobility sector. Regulators may impose stricter compliance requirements on startups. Moreover, investors will demand better due diligence processes.

BluSmart and Gensol under regulatory scrutiny as financial governance issues surface in recent investigations

The thousands of drivers suddenly left jobless by BluSmart’s shutdown are in urgent need of financial assistance and job placement support. Experts believe government intervention may be crucial in helping these individuals secure alternative employment opportunities quickly. Some industry voices have proposed integrating the affected drivers into the upcoming Sahkar Taxi initiative as a sustainable solution. This move could offer them job security while strengthening India’s cooperative-based transportation network.

For passengers, BluSmart’s collapse significantly narrows available options in the growing electric mobility segment, limiting eco-friendly transportation choices. In the short term, competitors like Ola and Uber may benefit from reduced competition and increased market share in key cities. However, these companies must take note and learn from BluSmart’s serious lapses in safety protocols and corporate governance. Strengthening passenger trust through transparent operations and strict safety measures should now be a top industry priority.

Conclusion

The BluSmart cab disaster represents one of India’s biggest startup failures. What began with safety incidents revealed massive financial fraud underneath. Ultimately, poor corporate governance destroyed a promising electric mobility venture.

The collapse affected multiple stakeholders differently. Drivers lost their livelihoods while investors lost their money. Meanwhile, customers lost a reliable transport option they had grown to trust.

Moving forward, the industry must learn from these failures. Better governance, stronger safety protocols, and regulatory oversight are essential. Only then can India’s mobility revolution proceed on solid foundations.

The BluSmart cab disaster serves as a stark reminder. Trust takes years to build but moments to destroy. For India’s startup ecosystem, this lesson cannot be forgotten.

External Links: