rump’s Tariff Tirade Unleashes Global Market Mayhem 2025

Trump’s Tariff Bombshell: Global Markets in Freefall : Recession

Picture this: it’s a Tuesday morning, April 2, 2025, and the world wakes up to a bombshell. U.S. President Donald Trump steps into the White House Rose Garden, flashes that signature grin, and drops a trade policy grenade that’s still reverberating across the planet. Sweeping tariffs—on over 180 countries, no less—are now the law of the land, and the fallout is nothing short of apocalyptic for global markets.

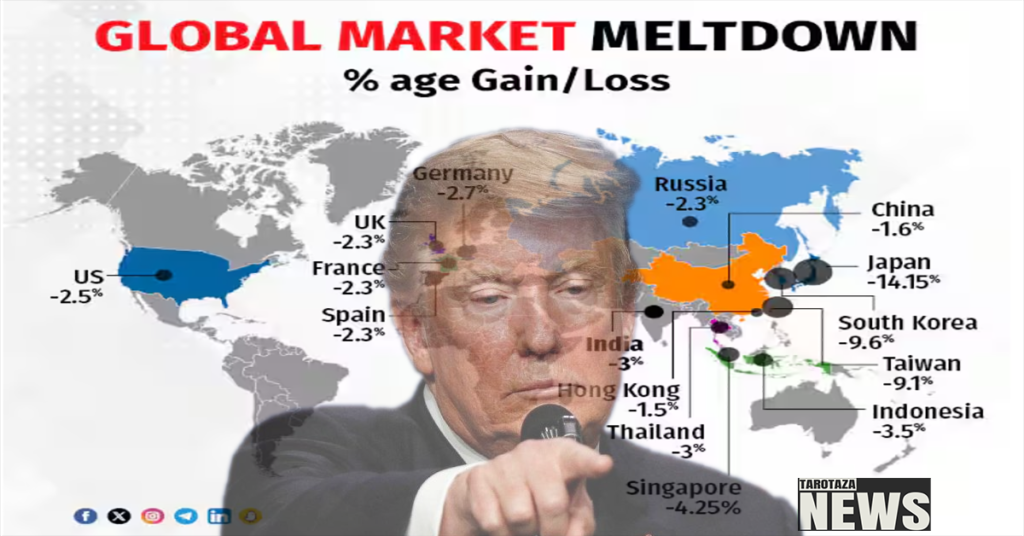

Asian exchanges are bleeding red, Wall Street’s in a tailspin, and everyday folks like you and me are left wondering: what the heck just happened?

Tariffs Unveiled: A Closer Look at the Chaos :Recession

Let’s break it down. Trump’s big announcement included a 26% “reciprocal tariff” on India, slated to kick in on April 9. That’s right—26% on everything from Bollywood DVDs to diamond jewelry, all because India supposedly slaps a hefty 52% tariff on U.S. goods. Trump’s calling it “kind” to only hit back with half that rate, but the markets? They’re not feeling the love.

Add to that a 10% baseline tariff on all imports starting April 5, a 25% tax on foreign-made cars (effective immediately), and even steeper rates for big players like China (34%) and the EU (20%), and you’ve got a recipe for economic chaos that’s got everyone on edge.

Markets in Meltdown: Wall Street and Asia Tank :Recession

The reaction was swift and brutal. By April 4, the Nasdaq had plunged 6%, officially slipping into bear market territory—think of it as Wall Street’s version of a bad breakup. The S&P 500 wasn’t far behind, tanking 4.8%, while the Dow Jones took a 1,600-point nosedive. That’s the worst single-day drop since the COVID panic of 2020, and it’s not just numbers—it’s people’s retirement savings, college funds, and dreams of that beach house evaporating in real time. Over in Asia, India’s BSE Sensex cratered by more than 2,200 points on April 7, and Japan’s Nikkei hit an eight-month low. It’s like the world’s financial markets decided to throw a collective tantrum.

Trump’s Trade War Rationale: Fairness or Folly? :Recession

So, what’s driving this mess? Trump says it’s about fairness—leveling the playing field for American workers who’ve been “ripped off” by countries with high tariffs on U.S. goods. He’s framing it as a patriotic power move, but the rest of the world isn’t buying it. Oil prices are plummeting—down 7% in a day—as fears of a global slowdown choke demand. Commodities like copper and steel are in freefall, and even gold, that shiny safe haven, dipped slightly in India despite the uncertainty. Investors are so spooked they don’t know where to turn.

The Looming Threat: Global Trade War and Recession Fears :Recession

The fear isn’t just about today’s losses—it’s about what’s coming. Economists are sounding the alarm that these tariffs could spark a full-blown global trade war, with retaliation already in motion. China’s slapped 34% tariffs on U.S. goods, the EU’s plotting its own countermeasures, and smaller players like Cambodia and Vietnam are staring down 50% rates that could crush their economies. It’s a domino effect: higher tariffs mean pricier imports, which means companies jack up prices or cut jobs, and suddenly your grocery bill and car payment are giving you heart palpitations.

And then there’s the R-word: recession. The Tax Foundation estimates Trump’s tariff spree will hit U.S. consumers with a $1.8 trillion tax hike, slashing imports by over a quarter in 2025. Oxford Economics predicts global growth could hit its lowest point since 2008, and JPMorgan’s pegging the odds of a global recession at 60%. Even Goldman Sachs, usually the cheerleaders of the financial world, has bumped its recession probability to 45%. For the U.S., this could mean two percentage points shaved off GDP this year—enough to turn a decent economy into a dumpster fire.

India in the Crosshairs: A Mixed Bag of Pain and Resilience :Recession

India’s caught in the crosshairs too, and it’s a mixed bag. That 26% tariff is bad news for sectors like diamonds, where over a third of exports head to the U.S. Picture diamond cutters in Surat sweating bullets as orders dry up—jobs are on the line, and companies like Tata Motors and Tata Steel are already watching their stock prices tank by double digits. But some experts, like Sujan Hajra from Anand Rathi Group, argue India might dodge the worst of it. With strong domestic demand, they say even a 10% drop in U.S. exports would only nick GDP by 0.2%. India’s growth could still hum along at 6.5% to 7.5% over the next few years—not too shabby when the rest of the world’s losing its mind. Still, don’t tell that to the traders on Dalal Street. The BSE Sensex’s 2,200-point plunge shows that panic doesn’t care about long-term forecasts—it’s about the here and now. And right now, it’s ugly.

Global Scramble and Trump’s Defiance: A World on Edge :Recession

Across the globe, countries are scrambling. Taiwan’s begging for a deal, offering to zero out its tariffs. Italy’s promising to prop up its industries. India’s in “talks,” but no one’s spilling the beans yet. Meanwhile, Trump’s out there shrugging it off, claiming on April 7 that “the markets are going to boom.” Buddy, have you checked the Dow lately? Trump’s not backing down, though. He’s tweeting up a storm, calling doubters “weak” and “stupid,” and insisting this is all part of his grand plan. His economic adviser, Kevin Hassett, says over 50 countries are negotiating, but with markets melting down and retaliation ramping up, it feels like putting a Band-Aid on a broken leg. The April 9 deadline for India’s tariff is looming, and unless something changes fast, we’re in for more pain.

The Real Cost: How Tariffs Hit Everyday Lives :Recession

Let’s talk about the human cost. These tariffs aren’t just Wall Street’s problem—they’re ours. That 25% car tariff? Say hello to pricier Toyotas and Hyundais. The 10% baseline? Your next iPhone or flat-screen TV might cost an arm and a leg. Companies don’t eat these costs—they pass them on to us, the regular Joes and Janes who just want to get through the month without breaking the bank. And if this trade war drags on, layoffs could follow. India’s diamond workers, America’s factory hands, China’s tech assemblers—real people, not just ticker symbols, are in the line of fire.

Uncertainty Ahead: What’s Next for the Global Economy? :Recession

So, where does this leave us? Staring down the barrel of uncertainty, that’s where. Markets hate surprises, and Trump’s handed them a whopper. The Fed might slash rates to stop the bleeding, but with oil tanking and confidence shot, it might not be enough. For now, it’s a waiting game—will this be a short-lived panic, or the start of an economic nightmare? One thing’s clear: Trump’s tariff tirade has lit a match, and the world’s economy is the kindling.