China's response to Trump's tariffs

Introduction : China’s response to Trump’s tariffs

Donald Trump has unleashed a bold move, slapping China with 125% tariffs on April 9, 2025. This decision ramps up the trade war between the world’s economic giants. The tariffs hit hard, targeting Chinese imports to curb what Trump calls unfair practices.

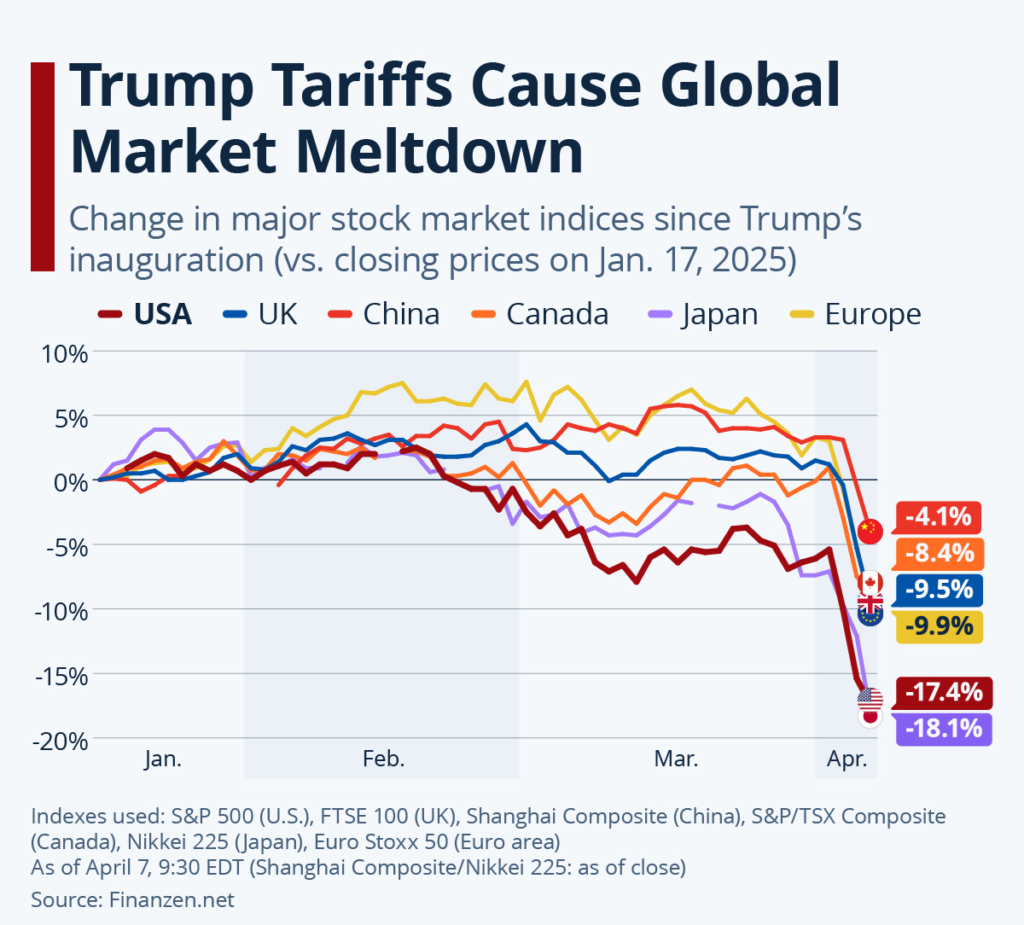

Markets trembled as the news broke, signaling chaos for global trade. China, a powerhouse in manufacturing, won’t sit quietly after this blow. Beijing’s next steps could reshape economies and shift alliances worldwide.

People everywhere are asking: how will China fight back? This article dives into China’s possible counterplays, from tariffs to global partnerships. It also explores the ripple effects on supply chains and beyond.

Trump’s gambit has raised the stakes, and China’s response to Trump’s tariffs will echo for years. Families buying gadgets or farmers selling crops will feel the fallout. Understanding China’s strategy is key to grasping this trade war’s future.

Let’s unpack the options Beijing might choose to tackle this tariff storm.

Section 1 : Hitting Back with Tariffs and Barriers – China’s response to Trump’s tariffs

China’s first instinct might be to slap higher tariffs on U.S. goods in return. They’ve already raised tariffs to 84% on American imports before. Now, with Trump’s 125% hike, Beijing could push them even higher.

This retaliation would sting U.S. farmers, tech firms, and carmakers fast. Soybeans, machinery, and whiskey might face steep price jumps in China. But tariffs alone won’t fully counter Trump’s massive blow.

China could also roll out non-tariff barriers to squeeze U.S. businesses more. Think tougher safety checks or endless paperwork for American exports. These quiet moves make it costly for U.S. goods to reach Chinese shelves.

Companies like Apple or Ford could see profits shrink overnight. China’s also got a trump card: rare earth minerals. They control most of the world’s supply, vital for phones and missiles. Cutting exports of these could cripple U.S. industries in months.

It’s a bold way to hit back without firing a shot. This mix of tariffs and barriers shows China’s ready to play hardball. They’ve done it before, and they’ll do it again. The U.S. might feel the pinch more than they expect. China knows interdependence cuts both ways in this trade war.

Beijing might target swing states to sway U.S. politics too. Higher tariffs on Midwest grain could spark voter backlash there. Non-tariff barriers, like port delays, could snarl U.S. shipments quietly. This strategy punishes American firms without headlines screaming “tariff hike.” China’s leaders are crafty, blending economics with geopolitics here. They’ll aim to make Trump’s base feel the heat directly. Retaliation isn’t just about money; it’s about leverage too. China could tighten rules on U.S. beef or tech imports subtly. These moves signal strength to the world and defiance to Washington.

Section 2- Playing the Currency Card – China’s response to Trump’s tariffs

China might tweak its currency, the yuan, to dodge Trump’s tariff hammer. A weaker yuan makes Chinese exports cheaper for everyone. This could blunt the 125% tariff’s bite on price tags. Back in 2019, they let the yuan slide a bit. It worked then, boosting sales despite U.S. pressure. Devaluing now could keep factories humming and jobs safe. But it’s not risk-free—money might flee China fast. Inflation could creep up, hitting ordinary folks at home. Still, it’s a quick fix to stay competitive globally. Trump’s team might cry foul, calling it manipulation again. That could spark more sanctions or heated talks. China’s weighing those odds as we speak.

Beyond currency, China could pump cash into its own economy. Tax cuts or new roads might spark more shopping domestically. Less reliance on exports means less pain from tariffs. Leaders in Beijing love this long-game approach. They’ve pushed “dual circulation” to lean on homegrown strength. It’s not flashy, but it builds a tougher China. They might also court new trade buddies elsewhere. Europe or Southeast Asia could buy more Chinese stuff. Deals with them would soften the U.S. market’s loss. This isn’t just survival; it’s a pivot to outlast Trump’s storm.

Section 3 : Building New Trade Bridges – China’s response to Trump’s tariffs

China could turn to other nations to dodge Trump’s tariff trap. Stronger ties with Europe might open fresh markets fast. A trade deal with the EU could replace U.S. buyers. Asia’s growing economies, like India or Japan, are options too. Beijing’s Belt and Road projects already link dozens of countries. Speeding those up could funnel goods away from America. It’s a slow burn, but it pays off long-term. China might sweeten deals with lower tariffs for allies. That pulls them closer while snubbing the U.S. hard. Diplomacy here is as crucial as economics.

China could also play the free-trade hero card. Trump’s protectionism leaves a gap Beijing might fill. Pitching open markets wins friends and weakens U.S. clout. Countries tired of tariffs might rally behind China instead. Think of it as a global charm offensive with cash. Leaders in Beijing see this as a power grab too. More trade partners mean less U.S. leverage over time. They’ve got the cash and ports to make it work. Smaller nations might jump at China’s offers quickly. This isn’t just about goods; it’s about rewriting alliances.

Section 4: Supply Chains in Chaos – China’s response to Trump’s tariffs

Trump’s tariffs could shake up global supply chains big time. Firms like Nike might ditch China for Vietnam fast. Moving factories isn’t cheap or quick, though. Costs go up, and shoppers pay more at checkout. Shortages of chips or toys could hit holidays hard. The U.S. consumer might grumble louder than expected. Other countries, like India, might snag new jobs from this. It’s a messy shuffle with winners and losers everywhere. China’s factories could idle if orders dry up. Workers there might face layoffs or worse soon.

Prices for steel or electronics might spike globally too. Inflation could force central banks to hike rates. That slows spending and cools economies worldwide. Businesses hate uncertainty, and this breeds plenty of it. Investment might freeze as CEOs watch the chaos unfold. The U.S. might feel smug, but pain spreads fast. China’s not the only one hurting here. Shipping firms and ports brace for slower trade too. Smaller nations caught in the crossfire lose out. This tariff war’s ripples touch everyone, everywhere.

Section 5: Looking Ahead – China’s response to Trump’s tariffs

This trade war’s long game looms large for China now. Tariffs sting, but they push Beijing to innovate faster. Tech like AI or chips could get homegrown boosts. Less need for U.S. parts means more control later. It’s a silver lining in this tariff cloud. China’s eyeing self-reliance as a shield against Trump. They’ll pour cash into science and factories soon. That could shift global power down the road. The U.S. might regret sparking this race.

Geopolitics shifts too as China courts new friends. Nations mad at Trump might lean Beijing’s way. That builds a bloc to challenge U.S. dominance quietly. China’s got to play it smart, though. Too much aggression could backfire with more sanctions. Balance is key in this high-stakes dance. They’ll mix retaliation with charm to win globally. The next few years hinge on these choices.

Conclusion

– China’s response to Trump’s tariffs Trump’s 125% tariffs have lit a fire under China’s economy. Beijing’s got options: tariffs, currency tweaks, and new trade pals. Retaliation with tariffs and barriers could hit the U.S. hard. Supply chains are buckling, and prices might soar soon. China’s not backing down; they’re plotting a counterattack now. Families and farmers worldwide will feel this clash. The trade war’s heating up, and stakes keep climbing. China’s next move could tip the global balance fast. Will they outmaneuver Trump or stumble under pressure? Time’s ticking, and the world’s watching closely.

1 thought on “China’s response to Trump’s tariffs : Facing Trump’s Tariff Blitz”