Introduction

In a country as diverse and populous as India, the well-being of its citizens, especially during their retirement years, is of paramount importance. For decades, the pension system in India has been a subject of much debate and discussion. The journey began with the traditional pension scheme, which offered a defined benefit, providing a sense of security to retired government employees. However, as economic realities evolved, the government introduced the New Pension Scheme (NPS) in 2004, marking a significant shift from defined benefits to defined contributions. While the NPS aimed to reduce the fiscal burden on the government, it also introduced a level of uncertainty for the employees, as their retirement benefits became tied to market performance.

The introduction of the Unified Pension Scheme (UPS) marks another significant milestone in the evolution of India’s pension system. Approved by the Union Cabinet, the Unified Pension Scheme is set to revolutionize retirement benefits for government employees, offering a balance between financial sustainability and security. This scheme is more than just a financial policy; it represents a commitment to the millions of government employees who have dedicated their lives to public service. The Unified Pension Scheme is designed to address the shortcomings of the NPS, providing assured benefits that can help retirees plan their post-service lives with confidence.

In this comprehensive exploration, we will delve into the intricacies of the Unified Pension Scheme, understanding its key features, the motivations behind its introduction, and the profound impact it is expected to have on the lives of millions of government employees. This analysis will also highlight the broader implications of this policy shift, not just for the individuals it directly affects but for the nation as a whole..

Background of Pension Schemes in India : Unified Pension Scheme Highlights

Unified Pension Scheme systems are critical in any society, as they provide financial security to individuals after their working years. In India, the concept of pensions for government employees has a long history, rooted in the colonial era. The traditional pension system, which was prevalent before the introduction of the NPS, operated on a defined benefit model. Under this system, retirees were assured a fixed monthly pension, usually a percentage of their last drawn salary, for the rest of their lives. This model was comforting to many, as it provided a predictable and steady income during retirement.

However, the financial sustainability of the traditional pension system was increasingly questioned as the years went by. The government, faced with mounting pension liabilities and an aging population, found it increasingly difficult to sustain this model. The burden on the exchequer was immense, leading to calls for reform. It was against this backdrop that the New Pension Scheme (NPS) was introduced in 2004.

The NPS represented a fundamental shift in the way pensions were managed. It moved from a defined benefit model to a defined contribution model, where the pension amount was no longer guaranteed but depended on the contributions made by the employee during their service and the returns generated by these contributions in the market. While the NPS aimed to reduce the fiscal burden on the government, it also transferred the investment risk to the employees, leading to a sense of uncertainty among retirees.

Over the years, the NPS has been a subject of much debate. While it offered the potential for higher returns, it also introduced volatility and unpredictability into the retirement planning of government employees. Many argued that the lack of assured benefits under the NPS was a significant drawback, especially for those who were not financially literate or comfortable with the risks associated with market-linked returns. The demand for a more predictable and secure pension system grew louder, leading to the conceptualization and eventual approval of the Unified Pension Scheme (UPS).

The Need for Reform :Unified Pension Scheme Highlights

The introduction of the NPS was a bold move aimed at addressing the financial challenges posed by the traditional pension system. However, it also highlighted the need for a more balanced approach to pension management. The NPS’s reliance on market performance created a scenario where retirees could face significant fluctuations in their pension income, depending on the state of the financial markets at the time of their retirement. This unpredictability was particularly concerning for those nearing retirement, as they had little time to recover from potential market downturns.

Moreover, the NPS’s defined contribution model placed a significant onus on employees to make informed investment decisions. While the system provided some level of flexibility in terms of investment choices, it also required a degree of financial literacy that not all employees possessed. As a result, many employees found themselves ill-prepared to navigate the complexities of the NPS, leading to dissatisfaction and a growing demand for a more secure and predictable pension system.

Employee unions and advocacy groups began to voice their concerns more vocally, arguing that the government had a responsibility to provide a stable and assured pension to those who had served the nation. The sense of uncertainty created by the NPS was seen as unfair, particularly for those who had dedicated decades of their lives to public service. The call for reform was not just about financial security; it was also about restoring trust in the pension system and ensuring that retirees could look forward to their golden years without fear of financial instability.

The Unified Pension Scheme was conceived as a response to these concerns. It was designed to bridge the gap between the need for fiscal sustainability and the need for assured benefits. The UPS aimed to combine the best aspects of both the traditional pension system and the NPS, offering a defined benefit that provided security, while also incorporating elements of flexibility and choice that had been introduced with the NPS.

Unified Pension Scheme Highlights: What is the Unified Pension Scheme?

The Unified Pension Scheme (UPS) is a comprehensive retirement benefits program introduced by the Indian government, specifically targeting government employees. The Unified Pension Scheme is designed to provide financial security and stability post-retirement, addressing the key concerns that arose from the NPS. At its core, the Unified Pension Scheme is a defined benefit scheme, meaning it offers a guaranteed pension amount to retirees, regardless of market performance.

The Unified Pension Scheme’s primary objective is to ensure that government employees can retire with confidence, knowing they will receive a stable and predictable income for the rest of their lives. This scheme represents a shift back towards the traditional values of the pension system, where the focus is on providing assured benefits rather than relying solely on market performance.

One of the standout features of the Unified Pension Scheme is its inclusivity. The scheme is designed to cater to a broad range of government employees, ensuring that everyone, regardless of their rank or tenure, has access to a secure and dignified retirement. The Unified Pension Scheme also includes provisions for family pensions, minimum pensions, and inflation indexation, making it a comprehensive and robust solution to the challenges posed by previous pension systems.

Unified Pension Scheme Highlights:Key Differences Between NPS and UPS

To fully appreciate the significance of the Unified Pension Scheme, it’s important to understand how it differs from the New Pension Scheme. While both schemes aim to provide retirement benefits to government employees, their approaches are fundamentally different.

- Assured Pension vs. Market-Linked Pension: Unified Pension Scheme Highlights

- The most significant difference between the NPS and UPS is the nature of the pension benefits. The NPS is a defined contribution scheme where the pension amount depends on the contributions made by the employee and the returns generated by those contributions in the market. In contrast, the UPS is a defined benefit scheme, offering an assured pension amount that is not subject to market fluctuations.

- Predictability and Security:Unified Pension Scheme Highlights

- The UPS offers a level of predictability and security that the NPS lacks. Under the NPS, employees face uncertainty regarding the exact amount they will receive as a pension, as it depends on market performance. The UPS, however, guarantees a fixed pension amount, providing retirees with peace of mind.

- Family Pension: Unified Pension Scheme Highlights

- While the NPS does include provisions for a family pension, the UPS takes this a step further by guaranteeing an assured family pension. In the event of the employee’s demise, their family will receive a fixed percentage of the employee’s last drawn salary, ensuring that dependents are financially secure.

- Inflation Indexation: Unified Pension Scheme Highlights

- The UPS incorporates inflation indexation, meaning that pension amounts are adjusted periodically to account for inflation. This feature is crucial in protecting retirees from the eroding effects of inflation, which can significantly impact purchasing power over time. The NPS does not have a similar mechanism, which can leave retirees vulnerable to inflationary pressures.

- Employee Choice: Unified Pension Scheme Highlights

- The UPS empowers employees with the choice to either remain in the NPS or switch to the UPS. This flexibility is a key feature, allowing employees to make decisions based on their individual circumstances and preferences. In contrast, the NPS did not offer such an option, leading to a one-size-fits-all approach that did not suit everyone’s needs.

- Gratuity: Unified Pension Scheme Highlights

- While both the NPS and UPS include provisions for gratuity, the UPS offers a more favorable calculation method. Under the UPS, employees receive a lump-sum gratuity based on a percentage of their monthly emoluments, providing them with additional financial security upon retirement.

Assured Pension -Unified Pension Scheme Highlights

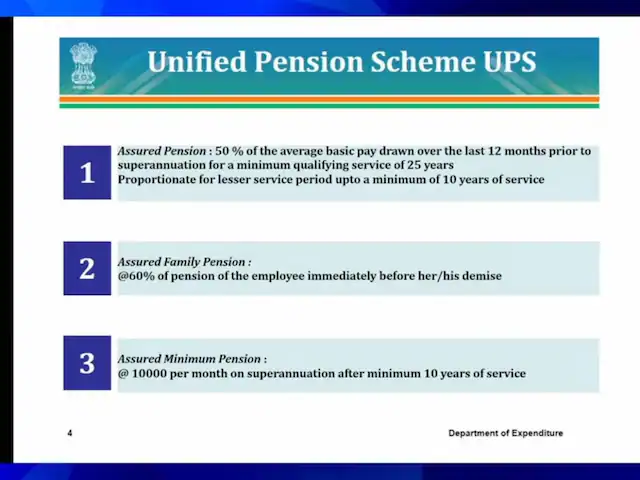

One of the cornerstone features of the Unified Pension Scheme is the provision of an assured pension. This feature addresses the primary concern that many government employees had with the New Pension Scheme—the lack of guaranteed benefits. Under the UPS, government employees are assured a fixed pension amount, calculated as 50% of the average basic pay drawn over the last 12 months before superannuation. This calculation method ensures that the pension amount fairly reflects the employee’s earnings during their service, providing a reliable income stream during retirement.

The importance of an assured pension cannot be overstated. For many retirees, the fear of outliving their savings or facing financial hardship in old age is a significant concern. The UPS alleviates these fears by guaranteeing a stable income, regardless of market conditions. This predictability allows retirees to plan their finances with greater certainty, making it easier to manage their expenses and maintain their standard of living.

Consider the case of Mr. Sharma, a government employee who dedicated 35 years of his life to public service. Under the NPS, Mr. Sharma faced the uncertainty of not knowing how much his pension would be, as it depended on the performance of his investments. The thought of market fluctuations impacting his retirement income caused him considerable anxiety. With the introduction of the UPS, Mr. Sharma can now retire with the confidence that he will receive a fixed pension amount, allowing him to enjoy his retirement without financial worries.

The assured pension feature of the UPS also serves as a safety net for those who may not be financially literate or comfortable with making investment decisions. By removing the investment risk from the equation, the UPS ensures that all government employees, regardless of their financial expertise, have access to a secure and predictable retirement income.

Assured Family Pension -Unified Pension Scheme Highlights

In addition to providing an assured pension to retirees, the Unified Pension Scheme also includes provisions for an assured family pension. This feature is designed to provide financial security to the families of government employees in the event of their demise. Under the UPS, the family of a deceased employee will receive 60% of the employee’s basic pay as an assured family pension. This provision ensures that the dependents of government employees are not left financially vulnerable during a time of grief and loss.

The assured family pension is particularly important for families that rely heavily on the income of the government employee. In many cases, the loss of a breadwinner can lead to significant financial challenges, especially if there are dependents such as children or elderly parents. The UPS addresses this issue by providing a stable and predictable income to the family, helping them to maintain their standard of living and meet their financial obligations.

Consider the case of Mrs. Verma, whose husband was a government employee. After his unexpected passing, Mrs. Verma was left to care for their two young children on her own. Under the NPS, Mrs. Verma would have received a pension that depended on the performance of her husband’s investments, adding a layer of uncertainty to an already difficult situation. However, with the UPS, Mrs. Verma is assured a fixed family pension, allowing her to focus on caring for her children without the added worry of financial instability.

The assured family pension feature of the UPS also highlights the scheme’s commitment to inclusivity and social security. By providing financial support to the families of deceased employees, the UPS ensures that no one is left behind, reinforcing the government’s commitment to the well-being of its citizens.

Assured Minimum Pension : Unified Pension Scheme Highlights

Another key feature of the Unified Pension Scheme is the assured minimum pension. This provision guarantees that all government employees, regardless of their length of service, will receive a minimum pension amount of Rs 10,000 per month. This safety net is particularly important for employees who may have served for a shorter period, as it ensures that they are not left without adequate financial support during retirement.

The assured minimum pension is a crucial aspect of the UPS, as it prevents retirees from falling into financial hardship. In the absence of such a provision, employees with shorter service periods or lower earnings could find themselves receiving a pension that is insufficient to meet their basic needs. The UPS addresses this issue by guaranteeing a minimum pension amount, ensuring that all retirees have access to a dignified and secure retirement.

Consider the case of Mr. Gupta, a government employee who joined the service later in life and was only able to complete 15 years of service before retiring. Under the NPS, Mr. Gupta’s pension would have been based on his contributions and market performance, which may not have been sufficient to provide a stable income. However, with the UPS, Mr. Gupta is assured a minimum pension of Rs 10,000 per month, providing him with the financial security he needs to live comfortably in retirement.

The assured minimum pension also serves as a social safety net, helping to reduce income inequality among retirees. By ensuring that all government employees receive a minimum level of support, the UPS promotes social justice and economic stability, contributing to a more equitable society.

Inflation Indexation – Unified Pension Scheme Highlights

One of the most innovative and important features of the Unified Pension Scheme is inflation indexation. This provision ensures that the pension amounts—whether it be the assured pension, family pension, or minimum pension—are periodically adjusted to account for inflation. Inflation is a critical factor that can erode the purchasing power of retirees over time, making it increasingly difficult for them to maintain their standard of living.

Inflation indexation is particularly important in a country like India, where inflation rates can fluctuate significantly. Without indexation, the real value of a pension could decrease substantially over the years, leaving retirees with less purchasing power to meet their needs. The UPS addresses this concern by incorporating a mechanism to adjust pension amounts in line with inflation, ensuring that retirees’ income keeps pace with rising costs.

Consider the case of Mrs. Iyer, a retired government employee who has been receiving her pension for the past 10 years. Without inflation indexation, Mrs. Iyer’s pension would have remained the same over the years, while the cost of living continued to rise. This situation could have led to financial strain, forcing her to cut back on essential expenses. However, with the UPS’s inflation indexation feature, Mrs. Iyer’s pension is adjusted periodically, allowing her to maintain her standard of living despite rising costs.

The inclusion of inflation indexation in the UPS is a forward-thinking approach that demonstrates the government’s commitment to the long-term well-being of its employees. By protecting retirees from the eroding effects of inflation, the UPS ensures that they can enjoy a dignified and secure retirement, free from the worries of financial instability.

Gratuity : Unified Pension Scheme Highlights

In addition to the assured pension, the Unified Pension Scheme also provides for a lump-sum gratuity payment upon retirement. Gratuity is a one-time payment made to employees as a token of appreciation for their service. Under the UPS, the gratuity amount is calculated as 1/10th of the monthly emolument (including basic pay and dearness allowance) for every completed six months of service. This provision provides retirees with a substantial amount of money that can be used to meet major expenses, such as purchasing a home, funding a child’s education, or covering medical costs.

The gratuity feature of the UPS is particularly important for retirees who may have significant financial obligations post-retirement. By providing a lump-sum payment in addition to the assured pension, the UPS ensures that retirees have access to the funds they need to meet these obligations. This financial support can be crucial in helping retirees transition smoothly into their post-service lives, without the need to dip into their savings or take on debt.

Consider the case of Mr. Rao, a government employee who plans to retire in a few years. Mr. Rao has been saving diligently for his retirement, but he still has some outstanding debts that he would like to pay off before retiring. The lump-sum gratuity payment provided by the UPS will allow Mr. Rao to clear his debts and enter retirement with peace of mind, knowing that he is financially secure.

The gratuity feature of the UPS also highlights the scheme’s focus on providing comprehensive financial support to retirees. By offering both a stable income stream and a lump-sum payment, the UPS ensures that retirees have the flexibility and financial resources they need to enjoy a comfortable and dignified retirement.

Employee Choice

One of the most empowering features of the Unified Pension Scheme is the provision for employee choice. Under the UPS, central government employees have the option to choose between remaining in the New Pension Scheme or switching to the Unified Pension Scheme. This flexibility allows employees to make informed decisions based on their individual circumstances, financial goals, and risk tolerance.

The ability to choose between the NPS and UPS is a significant departure from previous pension systems, which often imposed a one-size-fits-all approach on employees. By giving employees the power to choose, the UPS acknowledges that different individuals have different needs and preferences when it comes to retirement planning.

Consider the case of Ms. Mehta, a government employee who is nearing retirement. Ms. Mehta is a cautious investor and prefers the security of guaranteed benefits over the potential for higher returns. For her, the UPS, with its assured pension and inflation indexation, is the ideal choice, as it offers the stability and predictability she desires. On the other hand, Mr. Singh, a younger government employee with a higher risk tolerance, may prefer to stay in the NPS, as he is comfortable with market-linked returns and sees the potential for higher growth in his pension fund.

The employee choice feature of the UPS empowers individuals to take control of their retirement planning. It recognizes that there is no one-size-fits-all solution when it comes to pensions and allows employees to choose the scheme that best aligns with their financial goals and risk tolerance. This flexibility is a key strength of the UPS, making it a more inclusive and adaptable pension system.

PM Modi’s Vision : Unified Pension Scheme Highlights

The introduction of the Unified Pension Scheme aligns closely with Prime Minister Narendra Modi’s vision for a more inclusive and secure India. Throughout his tenure, PM Modi has emphasized the importance of financial dignity for all citizens, particularly those who have dedicated their lives to public service. The UPS is a manifestation of this vision, as it seeks to provide government employees with the financial security and stability they deserve in their retirement years.

PM Modi’s vision for India is one of inclusivity, where every citizen has access to the resources and opportunities they need to lead a dignified life. The UPS is a reflection of this vision, as it ensures that government employees, regardless of their rank or tenure, have access to a secure and predictable retirement income. By providing assured benefits, the UPS addresses the concerns of retirees and promotes financial stability, contributing to a more equitable and just society.

The introduction of the UPS also demonstrates PM Modi’s commitment to reform and innovation. The scheme represents a significant shift in the way pensions are managed, combining the best aspects of traditional pension systems with modern features such as inflation indexation and employee choice. This forward-thinking approach is in line with PM Modi’s broader agenda of modernizing India’s social security systems and ensuring that they meet the needs of today’s workforce.

In his public addresses, PM Modi has often spoken about the importance of ensuring that the fruits of India’s economic growth reach every citizen. The UPS is a concrete step in this direction, as it provides government employees with the financial security they need to enjoy a dignified and comfortable retirement. By prioritizing the well-being of those who have served the nation, the UPS embodies the values of inclusivity, security, and dignity that are central to PM Modi’s vision for India.

Conclusion :Unified Pension Scheme Highlights

The Unified Pension Scheme represents a paradigm shift in the way retirement benefits are managed for government employees in India. By offering assured benefits, inflation indexation, and employee choice, the UPS addresses the key concerns that arose from the New Pension Scheme, providing a more secure and predictable retirement income. This comprehensive and forward-thinking scheme reflects the government’s commitment to the well-being of its employees and aligns with PM Modi’s vision of financial dignity for all citizens.

As the UPS takes center stage, government employees can look forward to their retirement years with confidence and peace of mind. The era of uncertainty is behind us—the UPS promises stability, security, and dignity. Let us celebrate this paradigm shift and honor the commitment of our public servants, who have dedicated their lives to the service of the nation.

The impact of the Unified Pension Scheme will resonate across generations, providing a solid foundation for the financial security of millions of government employees. As we move forward, the UPS stands as a testament to the government’s dedication to creating a more inclusive, equitable, and secure future for all its citizens.

Click Here to more details:

1. The Hindu

More Stories

Dynamic Duo 2024: A Tale of Two Stars: Aditi Rao Hydari and Siddharth

Kolkata Protests 2024: A Detailed Analysis of the RG Kar Medical College Incident and the Nabanna Abhijan Movement

NEET PG 2024 Results Released: Celebrating Success in Medical Education